The Truth About Hermain Cain's 9-9-9 Plan: Poor Pay More, Rich Pay Less

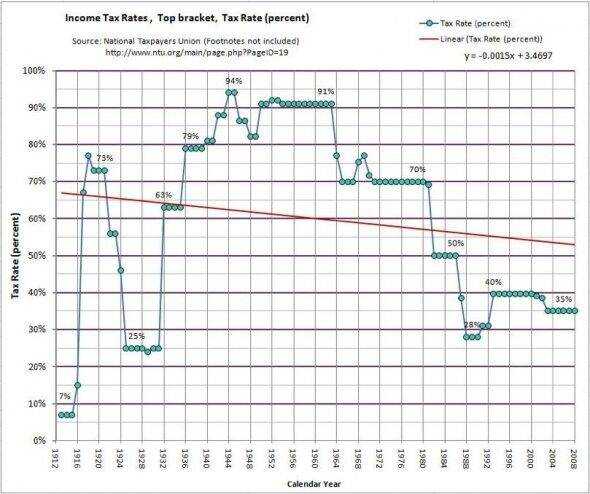

A lot of people have been commenting on Herman Cain's proposed overhaul of the tax system. I think it is important to understand a few key facts about this plan. First of all, for our friends on the right, this plan creates a new tax in the form of a national sales tax. I've heard many Republicans already show disdain for this. I think it is justified. However, I think the most important thing for all voters to realize is the truth about Cain's plan. Simply put, under a Herman Cain presidency, the poor would see their tax burden increase. The rich, on the other hand, would see their taxes decrease even further. How much longer will we let the right-wing lie to us with their trickle-down economics scam? How much funding needs to be cut before you the voter realizes the answer to our country's problems is not to slash spending in areas like education and social services, but rather should be found in decreasing defense spending and increasing taxes on our richest citizens and corporations? Even Warren Buffett has said it is time we stop coddling the rich (http://money.cnn.com/2011/08/15/news/economy/buffett_tax_jobs/index.htm). Let's put politics aside and stop blaming our poorest citizens for our problems. Let's hold the white collar criminals responsible for their crimes and force them to pay their fair share.

From NPR's Tamara Keith:

October 17, 2011

In the race for the Republican presidential nomination, Herman Cain has seen his popularity spike over the past couple of weeks. It was confirmed Monday, with a new CNN poll, showing him essentially tied with Mitt Romney at the front of the pack. Cain credits his success to three numbers: 9-9-9.

"Nine percent corporate business flat tax. Nine percent personal income flat tax. And a 9 percent national sales tax," explained Cain at last week's GOP debate. He went on to say his plan would pass "because the American people want it to pass."

Cain wants to scrap the current tax system and start over.

"It didn't come off a pizza box," said Cain, the former CEO of Godfather's Pizza. "It was well-studied and well-developed because it will replace the corporate income tax, the personal income tax, the capital-gains tax, the death tax and most importantly the payroll tax."

All those taxes would go away, replaced by a three-layered system, taxing business income, personal income and consumption -- each at 9.1 percent.

It's important to note that Cain's campaign hasn't released a ton of detail about the plan. The description of 9-9-9 on his website adds up to precisely 451 words, which is 39 more words than last week. Requests for further information from the campaign and its chief economic adviser got no response.

"What he's trying to do is to broaden the base and lower the rate. And that's what these do," says Gary Robbins, president of Fiscal Associates in Northern Virginia. He was hired by the campaign to do an independent analysis of the plan and he doesn't speak for the campaign.

"I guess I would have picked a different mix maybe and I might have done it a little bit differently than he did, but there's nothing wrong with what he said," Robbins says.

Fewer Exceptions

In today's tax code there are lots of exceptions and deductions -- like the mortgage interest deduction, the child tax credit, and the earned income tax credit for low income households. Cain would get rid of those too. His only deduction would be for charitable contributions.

Sales tax would apply to everything including milk, bread and medicine. The only things that wouldn't be taxed are used goods, like used cars and existing homes. Robbins says as a result Cain's plan would be able to raise as much money as the current tax code.

"The thrust of what he said is correct," says Robbins. "You can in fact drive the rates way down if you're willing to allow all the special dispensations that we grant these days to go away."

Robbins' written analysis, though, differs in significant ways from what is on Cain's website. Robbins assumes a tax break for all poor people, while the website doesn't.

The Cain plan has sent some of the nation's top tax wonks into overdrive, analyzing what it would mean for taxpayers. Edward Kleinbard, a law professor at the University of Southern California and a former chief of staff for the congressional Joint Committee on Taxation, just wrote a paper about 9-9-9. His conclusion?

"The rich will find their tax bills going down, and the majority of working Americans would find their tax bills going up, quite substantially," says Kleinbard.

Who Pays?

He says under Cain's plan, a family earning $120,000 a year would see its after-tax disposable income drop by about $500.

"Basically from that point down, most everybody is worse off, and the further down the income ladder you go, the extent to which a family is worse off under the Cain plan increases dramatically," says Kleinbard.

For a family of four earning $50,000 a year, Kleinbard says the hit would be about $5,000 under the 9-9-9 plan. Cain told NPR last week that same family would be better off, but several tax experts disagree. Roberton Williams, a senior fellow at the Tax Policy Center, says for the lowest-income Americans, the tax hit under 9-9-9 would be even more substantial.

"There are 30 million people who currently pay neither the federal income tax, nor federal payroll taxes, and those people would see a 9 percent tax on their income as well as a 9 percent tax on every dollar they spend," says Williams. "So for those people it's definitely a large tax increase."

On NBC's Meet the Press yesterday, Cain admitted that some people wouldn't be better off.

"Some people will pay more. But most people would pay less is my argument," said Cain. When asked who will pay more, he said, "the people who spend more money on new goods."

Economists say generally people who make less money spend a larger share of their income on food and other essentials. Cain suggests that even if this is true, they can change their behavior and purchase more used items.

http://www.npr.org/2011/10/17/141427450/herman-cains-9-9-9-plan-gets-a-closer-lo...

Or, as James Carville says:

"Herman can't even make an edible pizza. Republican or not -- you have to admit, that stuff was pretty bad."

Comments

-

-- Posted by Dexterite1 on Tue, Oct 18, 2011, at 6:09 AM

-

-- Posted by Actually on Tue, Oct 18, 2011, at 1:00 PM

-

-- Posted by Actually on Tue, Oct 18, 2011, at 1:08 PM

-

-- Posted by Actually on Tue, Oct 18, 2011, at 1:10 PM

-

-- Posted by Actually on Tue, Oct 18, 2011, at 1:19 PM

-

-- Posted by turdjerker on Fri, Oct 21, 2011, at 5:39 PM

-

-- Posted by Dexterite1 on Sat, Oct 22, 2011, at 6:59 AM

-

-- Posted by Actually on Mon, Oct 24, 2011, at 1:50 AM

-

-- Posted by swift on Fri, Oct 28, 2011, at 4:39 PM

-

-- Posted by BonScott on Mon, Oct 31, 2011, at 10:06 PM

Respond to this blog

Posting a comment requires free registration:

- If you already have an account, follow this link to login

- Otherwise, follow this link to register